More About Hiring Accountants

More About Hiring Accountants

Blog Article

Everything about Hiring Accountants

Table of ContentsThe 20-Second Trick For Hiring AccountantsFascination About Hiring AccountantsNot known Facts About Hiring AccountantsWhat Does Hiring Accountants Mean?Some Known Details About Hiring Accountants

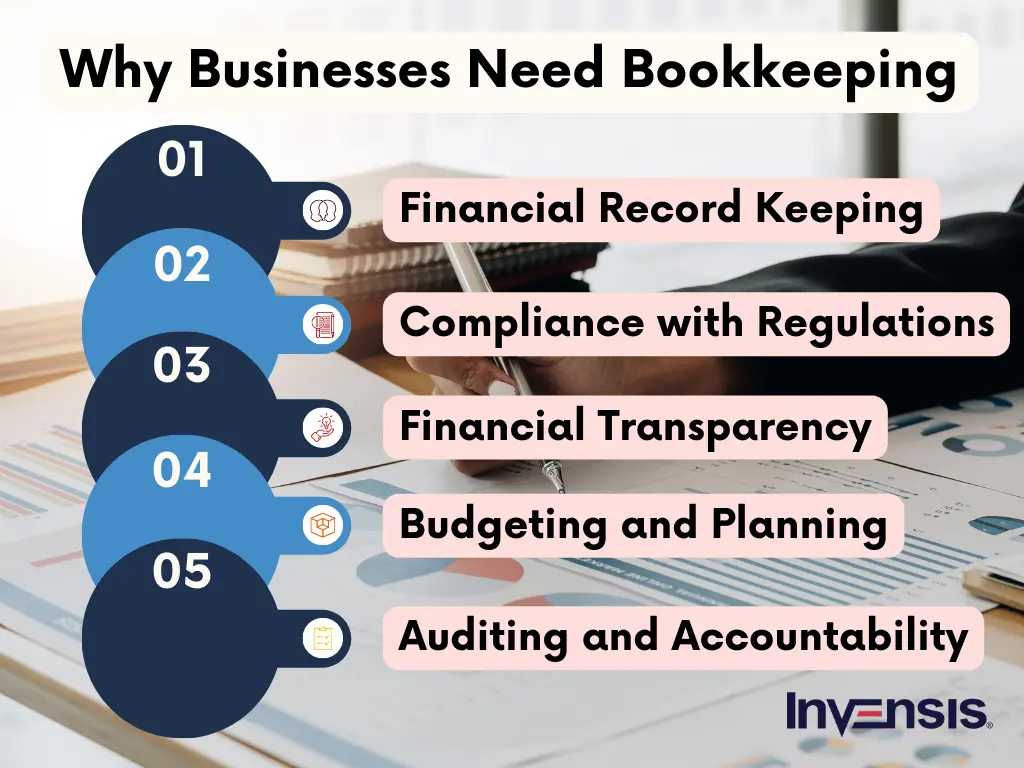

Is it time to work with an accountant? If you're an SMB, the appropriate accountant can be your buddy. At costs, we have actually seen firsthand the transformative power that business owners and accounting professionals can open together. From enhancing your tax obligation returns to examining finances for improved profitability, an accounting professional can make a huge difference for your organization.An accountant, such as a state-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT), has specialized knowledge in monetary management and tax compliance. They remain up to date with ever-changing guidelines and best methods, making sure that your service remains in conformity with legal and regulative requirements. Their expertise allows them to navigate complex financial issues and offer precise trusted guidance tailored to your specific organization demands.

They can also connect you with the right implementation teams so you know you're establishing everything up correctly the very first time. For those who do not already have an accountant, it might be difficult to know when to connect to one - Hiring Accountants. What is the oblique point? Every organization is different, however if you are encountering challenges in the complying with locations, now may be the correct time to bring an accountant on board: You do not need to write a business plan alone.

Hiring Accountants Fundamentals Explained

The risks are high, and an expert accountant can help you get tax obligation recommendations and be prepared. We recommend talking to an accountant or other finance specialist regarding a number of tax-related goals, consisting of: Tax obligation preparation methods.

By collaborating with an accountant, organizations can strengthen their financing applications by giving much more accurate economic details and making a better case for financial practicality. Accounting professionals can also assist with tasks such as preparing why not check here monetary papers, assessing monetary information to evaluate creditworthiness, and creating a comprehensive, well-structured loan proposition. When points alter in your business, you desire to make certain you have a strong handle on your finances.

Are you prepared to sell your organization? Accounting professionals can help you establish your business's worth to assist you protect a fair offer.

Hiring Accountants Fundamentals Explained

People are not called for by legislation to keep economic books and documents (companies are), but not doing this can be an expensive mistake from an economic and tax viewpoint. Your savings account and credit history card declarations may be incorrect and you may not find this until it's too late to make modifications.

Whether you need an accountant will more than likely depend upon our website a few factors, including exactly how complex your taxes are to submit and how numerous accounts you need to handle. This is an individual who has training (and likely an university level) in audit and can handle bookkeeping jobs. The hourly price, which again depends on place, work summary, and proficiency, for an independent accountant has to do with $35 per hour on ordinary however can be considerably extra, equalize to $125 per hour.

The 30-Second Trick For Hiring Accountants

While a CPA can provide bookkeeping solutions, this specialist might be too expensive for the task. Per hour costs for Certified public accountants can run about $38 per hour to begin and increase from there. (Most Certified public accountants do not handle accounting solutions directly however use a staff member in their firm (e.g., an accountant) for this job.) For the jobs described at the start, an individual accountant is what you'll need.

It syncs with your financial institution account to simplify your individual funds. You can work with a bookkeeper to aid you obtain started with your individual accountancy.

You make a decision to manage your personal accounting, be certain to separate this from bookkeeping for any business you own.

Fascination About Hiring Accountants

As tax season techniques, people and services are faced with the perennial inquiry: Should I tackle my tax obligations alone or work with an expert accounting professional? While the attraction of saving money by doing it on your own might be alluring, there are compelling reasons to think about the proficiency of a qualified accountant. Below are the leading factors why hiring an accountant might be a sensible investment compared to browsing the complicated world of taxes on your own.

Tax obligations are complex and ever-changing, and an experienced accountant remains go to this website abreast of these adjustments. Working with an accounting professional releases up your time, allowing you to focus on your personal or business tasks.

Report this page